The Hidden Costs of Outdated Equipment, And How Equipment Financing Can Help

Posted On: July 29, 2025 by Falcon National Bank in: Manage your Business | Business Banking

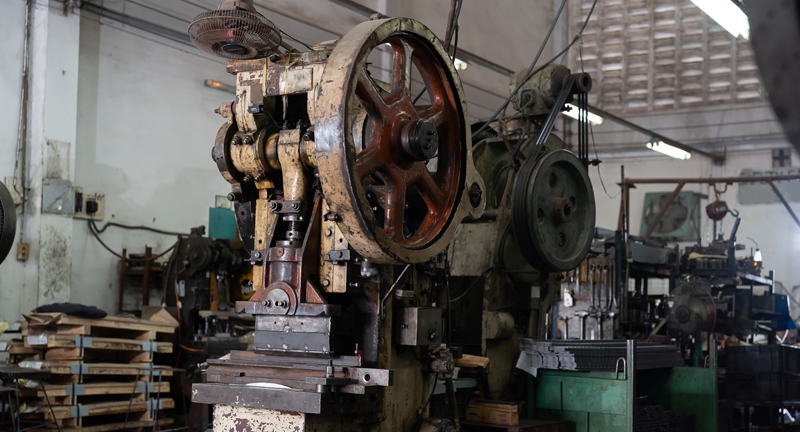

Outdated equipment does more than slow you down, it quietly chips away at your bottom line. In the manufacturing world, every minute counts. When machines under perform, require constant repairs, or can’t keep up with production demands, they create inefficiencies that cost you time, money, and missed opportunities.

Fortunately, updating your equipment doesn’t have to drain your cash reserves. With the right equipment financing strategy, you can invest in modern technology while preserving working capital and boosting profitability.

The Real Cost of Running on Old Equipment

Old or inefficient equipment can affect your manufacturing operation in ways you may not realize, including:

- Increased Maintenance Costs

Frequent breakdowns don’t just cost money; they cause unexpected downtime and delay orders. - Lost Productivity

Older machines are slower, harder to operate, and less precise, impacting output and product quality. - Higher Energy Usage

Outdated equipment is often less energy-efficient, leading to higher utility costs over time. - Lower Competitive Advantage

Falling behind technologically can mean losing out on large contracts, custom jobs, or compliance opportunities.

Why Equipment Financing Makes Sense

Investing in new machinery or technology can feel overwhelming, but it doesn’t have to. Equipment financing allows manufacturers to upgrade without compromising liquidity or draining cash reserves.

Here’s how it works—and why it benefits your business:

Spread Costs Over Time

With fixed monthly payments, you can budget more effectively and avoid large upfront expenses.

Preserve Working Capital

Keep your cash available for other needs, like payroll, raw materials, or emergencies.

Potential Tax Benefits

Depending on your situation, you may be eligible to deduct interest or depreciate equipment under IRS Section 179.

Stay Technologically Current

Financing allows you to upgrade faster and more often, so you stay competitive and compliant.

Flexible Terms for Your Business

From 3 to 7+ years, you can often structure payments to align with your cash flow cycle or seasonality.

What Can You Finance?

Most banks offer financing for a wide range of manufacturing needs, including:

- CNC machines

- Robotics and automation systems

- Packaging equipment

- Printing or labeling machines

- Facility upgrades tied to production

- Delivery vehicles and forklifts

Is It Time to Upgrade? Let’s Talk.

If your machines are costing more in maintenance than they’re worth, or you’re ready to scale production, equipment financing may be the right move. At Falcon National Bank, we specialize in helping manufacturers grow smarter, not just faster.

Invest in Growth Without Sacrificing Cash Flow

Talk to our equipment finance team today about financing options that help you stay competitive and efficient, without financial strain.

0 comments