BUSINESS CHECKING

AND SAVINGS

Real solutions you can bank on.

We'll help you choose the checking or savings account that is right for your business.

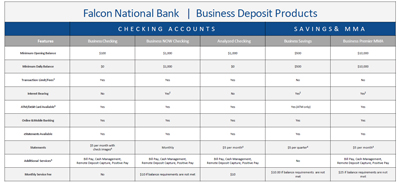

Checking Accounts

Business Checking: Basic checking with all the standard features for your business

- $100 minimum deposit to open account, no minimum daily balance requirements

- No fees on the first 250 items, $0.10 per item after 2501

- Includes debit card, free online banking, free Bill Pay, and free eStatements ($5 for paper statements)

- Additional Cash Management, Remote Deposit Capture, Positive Pay services available2

Business NOW Checking: For sole-proprietors, non-profits, IOLTAs & REALTAs

- Business checking for the sole proprietors, non-profits, IOLTAs & REALTAs

- $1,000 minimum deposit to open account, $1,000 daily balance required to avoid $10 monthly service fee

- No fees on the first 250 items, $0.10 per item after 2501

- Includes debit card, free online banking, free Bill Pay, and free paper statements or eStatements

- Additional Cash Management, Remote Deposit Capture, Positive Pay services available2

- Earn a variable interest rate3, compounded monthly. Click here for current rates.

Analyzed Checking: Designed to accommodate unlimited transaction volume

- $1,000 minimum deposit to open account, no minimum daily balance requirements

- Earn credit on qualifying balances to off-set fees

- $10 monthly service fee

- $0.10 per item fee for ACH debits, credits, checks written, and other debit items; $0.04 per item fee for local items deposited; $0.08 per item fee for all other checks deposited.

- Includes debit card, free online banking, free Bill Pay, and free eStatements ($5 for paper statements)

- Additional Cash Management, Remote Deposit Capture, Positive Pay services available2

Savings Accounts

Business Savings: Save money while your business grows

- Basic savings with all the standard features you need for your business

- $500 minimum deposit to open account, $500 daily balance required to avoid $10 monthly service fee

- Includes free online banking, and free eStatements ($5 for paper statements)

- Earn a variable interest rate3 , compounded quarterly. Click here for current rate.

Business Premier MMA: Park your money and watch it grow

- $10,000 minimum deposit to open account, $10,000 daily balance required to avoid $25 monthly service fee

- Includes debit card, free online banking, free Bill Pay, and free eStatements ($5 for paper statements)

- Additional Cash Management, Remote Deposit Capture, Positive Pay services available2

- Earn a variable interest rate3, compounded monthly. See current rates.

- No fees on the first 6 debit/withdrawal transactions, $2.50 per transaction after 6.

Expanded FDIC Deposit Insurance Protection

At Falcon National Bank, your deposits are fully insured up to the standard FDIC coverage limit of $250,000 per customer. For balances exceeding this amount, we offer expanded FDIC protection through IntraFi® Network Deposits. With this service, we strategically divide your deposit into smaller portions, each under $250,000, and distribute these across a network of financially stable banks. This way, your entire deposit remains fully insured, while you continue to manage your accounts with Falcon National Bank.

Insured Cash Sweep® (ICS):

Your deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The amounts are then placed into deposit accounts at multiple FDIC-insured banks. As a result, you can access FDIC coverage from many institutions while working directly just with us.

Certificate of Deposit Account Registry Service® (CDARS):

When your Certificate of Deposit funds are placed through CDARS, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The funds are then placed into deposit accounts at other network banks. As a result, you can access FDIC coverage from many institutions while working directly with just us.

See these options side by side.

Access our comparison chart

Let's get you started!

Visit us in branch or connect with a business banker. We look forward to being a part of your financial future.

We'll help you choose the checking or savings account that is right for your business.Let's get you started

Visit us at a local branch. We look forward to meeting you!

Locations & Hours

“People bank with people who they know and trust. We're successful because we've created an approach that instills great trust in our services and our team. Our customers also know we're locally owned and focused on investing in our community. My greatest reward is seeing local businesses grow and experience financial success.” - Troy Cameron, Market President, St. Cloud

1. No fees on the first 250 items, $0.10 per item after 250. Refer to the Business Deposit Account Disclosures to learn more.

2. Fees may apply for these services. See fee schedule for details.

3. Variable Rate - The interest rate and annual percentage yield for your account depends upon the applicable rate/tier. The interest rate and annual percentage yield may change at any time at the bank's discretion. See current rates here.